Approvology™ is the science of helping improve lives with better credit. We are a group of dedicated professionals working together to make sure our customers achieve financial freedom.

How do I get started with Approvology?

You begin and signup anytime in just three easy steps and it only takes a few minutes. As soon as you sign up you will receive a welcome email and text. Soon after we will assist you in getting your initial credit reports and perform a complete audit and analysis. If you sign up today, we should have your first round work done within a few days and results as quick as 30 days!

I just signed up for a credit repair program, what happens next?

The entire process can be found at our Step by Step Overview page.

What documents or information do I need to provide at the beginning?

After signup, you will need to provide your Drivers License, Copy of your Social Security Card, and a utility bill with our name and address for verification purposes. These are documents that are required by the bureaus.

How will I know it works?

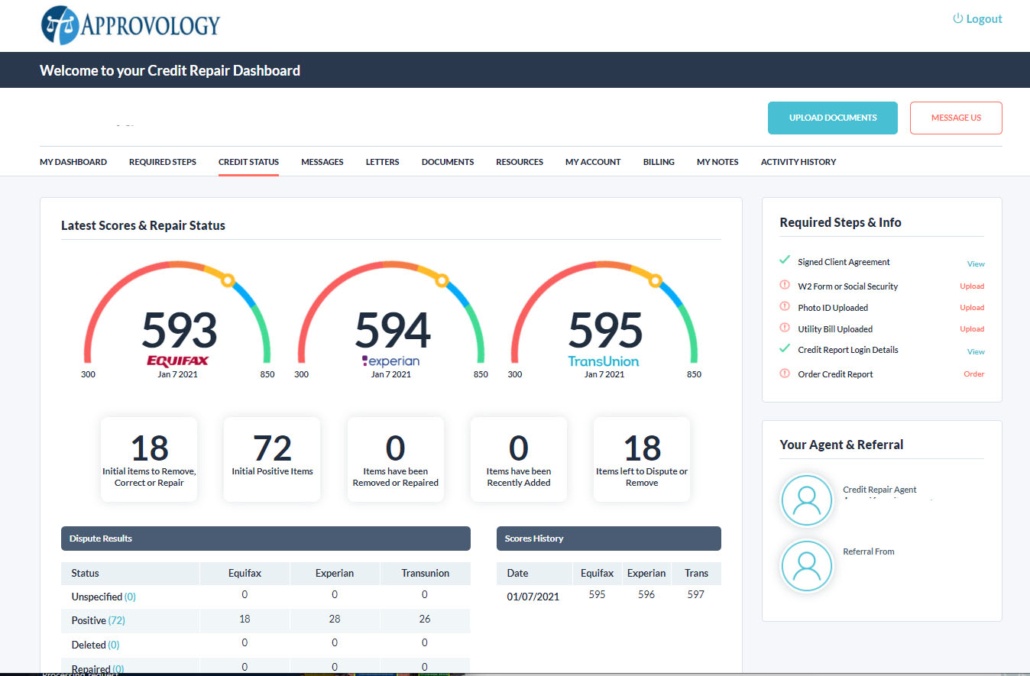

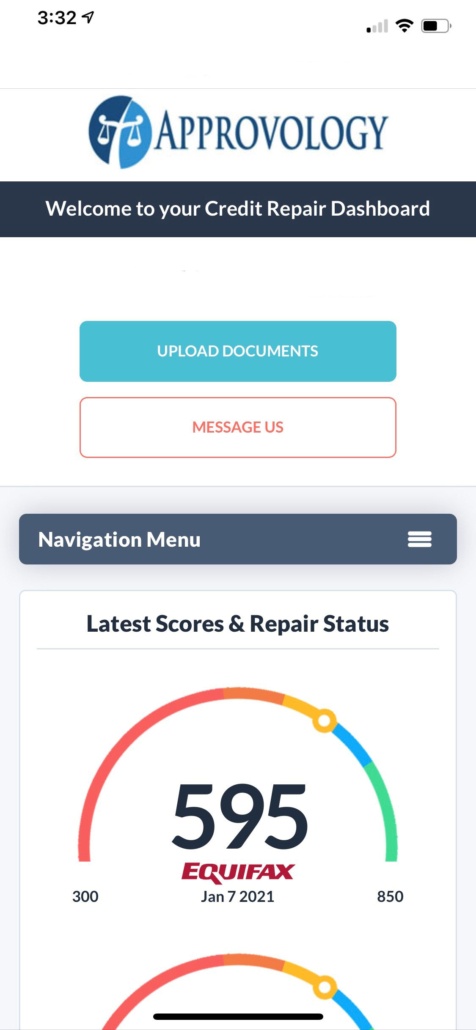

Your mobile friendly portal with leading edge technology will provide you updated reports throughout your entire program and beyond if you choose to continue with our unique Alumni program. You will see all items that have been removed, changes, or updated, which typically means that you a positive improvement has been made. If an account was removed, it means that a negative item has been removed from your credit report.

Is my data and information safe with your credit repair program?

Yes. Keeping your personal information secure and confidential is a top priority. We have invested in end-to-end security and privacy technology through every step of the way. Details include: encryption with ciphers, 256-bit advanced encryption, on-going level 1 PCI compliance, 24/7 monitoring, Trust Guard PCI Compliance and PCI DSS Compliance and auditing. Additionally, our staff is fully trained in confidentiality and privacy procedures.

Is there a credit repair program discount for couples?

Yes. Sign up your spouse or partner during your order process, or up to three days following your order. You do not have to be married to get the discount; however, the other individual should be from the same household. The additional member will get 50% off both the setup and monthly fees.

Do you have a military discount available?

Yes, in honor of our military members and as a Thank You for your service, we a 15% discount on your monthly fees. The 15% discount will be for all retired and active duty personnel. Once you sign up, make your initial payment and provide a valid military id, we will apply the 15% discount to your monthly billing.

How will I know what progress is being made?

Your state of art and mobile friendly portal will provide you real-time updates of your program along with updated credit scores and details of the process.

Are credit repair companies a scam?

This is a particularly damaging myth, as the services of a reputable credit repair company are invaluable to the credit repair process. The most important word in that phrase is “reputable.” There are simple ways for wedding out the credit repair scams from the rest of the market, which largely consists of effective and trustworthy credit repair companies.

It is critical that you do some research on the credit repair company you are considering working with and make sure it follows the guidelines of the Credit Repair Organizations Act (CROA). This consumer protection regulation “prohibits untrue or misleading representations and requires certain affirmative disclosures in the offering or sale of credit repair services.”

There are a couple key consumer protections the CROA outlines include:

While the CROA regulates the credit repair services, you still have a role to play in researching which firm is the best option.

Consider asking these questions:

Finally, be very careful with any company that offers you a guarantee of results. This is a red flag to be on the lookout for, as well as an unlawful practice.

Approvology is one of the fastest growing and best reviewed credit repair firms in the US. Let us help you improve your life with better credit.

What does the client portal look like?

What is more important, the credit score or the credit report?

The credit repair process is centered on your credit report, not your credit score. Your report and your score are two separate things. The score is the outcome of actions taken to repair your report.

The main things to consider here is that credit repair is focused on making sure your report is 100% accurate, fair and substantiated; therefore, the credit repair process is more about going through your report very carefully to find inaccurate information and attempting to fix the issues.

Will my credit score jump immediately with credit repair?

While credit repair is a proven strategy for addressing bad credit, it won’t improve your credit immediately. Typically, those who may be dissatisfied with the timing of credit repair are looking at their scores every day and expecting it to increase quickly.

When a mistake or error is found on your credit report, the next step is to dispute the inaccurate negative item with the bureau. Once a dispute is started with a credit bureau, the reporting agency has 30 days, and in some cases 45 days, to respond. It may correct or remove the negative item at the end of that time, but the impact to your credit score will still take some time to show. In general, with credit repair is that you can expect it to take around six months for results to appear. Sometimes it may be longer, especially if you are disputing several aspects of your credit report.

There may be other elements to a poor credit score that are holding you back, and which credit repair alone cannot fix. For awareness, the five factors of a credit score are: Payment history, Utilization, Account mix, Hard inquiries and Age of accounts.

How much can I expect my credit score to increase with these programs?

That is nearly impossible to predict. There are no two credit reports that are the same and there the average never applies. We have seen scores go up more than 250 points and others just the 20-50 point boost they needed to qualify for their mortgage or auto loan. Everyone’s results vary, we assure you we will get the best results possible and with our 90 Day Guarantee, you have nothing to lose.

Can I pay more to speed up the program?

The Ultimate package is the most aggressive and is most likely to get you the fastest results. There is nothing more that you can pay for to make faster progress. We service each case as fast possible. There is no legal way to make things disappear faster and from the time the bureaus recieve your dispute, they have 30 days to respond by law.

Will a team or only one person be assigned to my program?

There will be a team working on your program and generally we have all our clients supported by the entire team; however, if you want only one person we can accommodate that request. Your customer portal lets you communicate with your advisors directly.

How much time is spent on a specific item?

Based upon your specific situation we dispute items every 30-45 days. Most other companies may randomly challenge items with no strategy. Approvology has a unique and scheduled strategy to deliver optimal results in the shortest time possible. We do not automate or simply challenge all items at the same time. We strive for the beset results possible for our customers.

When I get my credit reports, will it hurt or lower my scores?

We recommend only soft pull credit inquiries to update your reports. If enrolled in the Platinum or Ultimate package, these reports are included and do not effect your credit nor scores. With the plus package we help you obtain this information for your program free of charge without incurring any additional fees.

Do you just send letters and hope creditors do no respond in time?

No, this tactic will yield very poor results. Millions of disputes are processed monthly and they are prepared for this magnitude of letters. We attach each item on your credit and expect a response. All our responses are custom and unique. Our effectiveness is one reason why we are one of the fastest growing and best reviewed credit repair firms in the US.

Can I apply for credit while in a credit repair program?

Yes, your credit is your own; however, be aware that applying for new credit will add new inquiries to your credit report, which will negatively impact your credit score. We encourage everyone to wait at least a few months before applying for new credit.

Will you help me build new credit?

At Approvology we know credit repair is complicated and time consuming, but is only one portion of the end goal. With our assistance and resources that are included, Approvology will help you obtain new credit lines. We know the best options to fit your needs and best chances of approvals.

What does a credit repair program do to help?

Approvology helps clients attack their damaged credit by challenging, and in most cases, removing, inaccurate, untimely, misleading, biased, incomplete, or unverifiable negative items from their reports. That is why Approvology is one of the fastest growing and best reviewed credit repair firms in the US.

What items can be removed with our credit repair programs?

Approvology has removed nearly everything imaginable. A more appropriate question would be, what items can not be removed? Some examples include: late payments, charge offs, foreclosures, judgements, repossessions, incorrect addresses, closed accounts, bankruptcies, negative settlements, liens, collections, and much more!

How do you rebuild bad credit?

We review your credit reports and see what is hurting your score and immediately start working on any inaccurate, untimely, misleading, biased, incomplete, or unverifiable items on your credit report. Addressing them accordingly and utilizing different laws, such as the Fair Credit Reporting Act and other laws applicable to increase scores. At the same time providing you a tailored plan to avoid future credit problems and credit education along the way to make sure you have a healthy and accurate credit life after our program.

What is the cost of our credit repair programs?

The Platinum package is our most popular and the Ultimate package is the most aggressive. Our prices and details of each package can be found at https://approvology.com/progams-pricing/. You can cancel at anytime and all packages come with a 90 day money back guarantee.

How soon should I start to see results from credit repair?

Approvology will have your first round of work processed and sent within five business days from your start date. Credit Bureaus have 30 days by law to process everything submitted. You should to start see results in about 30-60 days from your start date. You can cancel at anytime you are not satisfied with your results.

How long does it take to repair credit?

Typically you should to start seeing results in 30-60 days from your start date. Each situation is unique and so is the timeframe required for the repairs. Approvology works on your credit on a month to month basis until you are satisfied with the improvements in your credit. Our goal is to improve both your report and score continuously every month. Most of our customers are ready for graduation in about 6 months, some are happy to end early and some continue longer or enroll in our lower cost Alumni Program.

Can late payments be removed from credit reports?

Yes, our methods of disputing have proven to remove late payments. This is one of most popular removals in our programs.

Can student loans be removed from credit reports?

Late payments on student loans can be removed; however, student loan debt can not be settled.

Can bankruptcies be removed from credit reports?

Bankruptcies are public record and are typically the most difficult to remove if they are within 7 years old; however, we have had good success removing many.

Can repossessions be removed from credit reports?

Yes, our proven methods can remove repossessions; however, they are difficult. We will do our best to get them removed.

How can bad credit be repaired legally?

It is your right and responsibility to assure the accuracy of items on your credit reports. Due to the Faire Credit Reporting Act (FCRA), Fair Credit Billing Act (FCBA) and the Fair Debt Collections Practices Act (FDCPA) you have the legal right to dispute inaccurate, untimely, misleading, biased, incomplete, and unverifiable items on your credit reports with the bureaus and your individual creditors. Many people have legally and successfully restored their credit and increased their credit score by simply enforcing their own legal rights.

If a negative item is successfully deleted from a credit report, can it come back?

It is possible for a negative item that has been deleted to be verified by a credit after the deletion is complete. When this happens the Fair Credit Reporting Act (FCRA) requires bureaus to inform you before re-reporting items that have been deleted. It is very rare to have an item removed and replaced, but it is possible.

With credit repair do I need to keep paying my bills?

Yes, it is your responsibility to protect your credit while we working on your history. If you add new damage to your credit report, you will be working against us.

Can I fix my own credit?

Yes, you can do your own credit repair process, but like most professional services, we have knowledge, experience, and process that get you the best results fast.

Does paying my bills restore my credit?

Paying your bills on time every month will build your credit history, but it will not repair the past. There is little difference between a paid negative item and an unpaid one on your credit report.

How low should my credit card balance be for credit repair?

The optimal balance for credit cards is under 30%. If you are able to keep them even lower, it will drastically help you improve your scores. You must continue to use your credit cards each month, making small purchases on each one to show you are using credit responsibly. You should not close any accounts without first consulting with us.

Can creditors remove negative, but accurate items off credit reports?

There is no requirement for any item to stay on your credit report. The credit grantor or bureau may choose to delete an item whenever they see fit.

Is credit repair right for you?

Approvology are experts in finding incorrect, unfair, or unsubstantiated negative items and getting them removed. We know how to dispute in a way that has the highest chance of being moved toward investigations. Everybody’s situation is different. It is clear that bad credit can have incredibly harmful and expensive consequences, so improving your score should be something you make a priority.

Does credit repair really work?

Yes, credit repair services can be very effective and have changed many lives. Working with a company like us greatly increases your chances of success.

What is Approvology?

ApprovologyTM is the science of helping improve lives with better credit. We are a group of dedicated professionals working together to make sure our customers achieve financial freedom.